Peer to peer lending no credit check

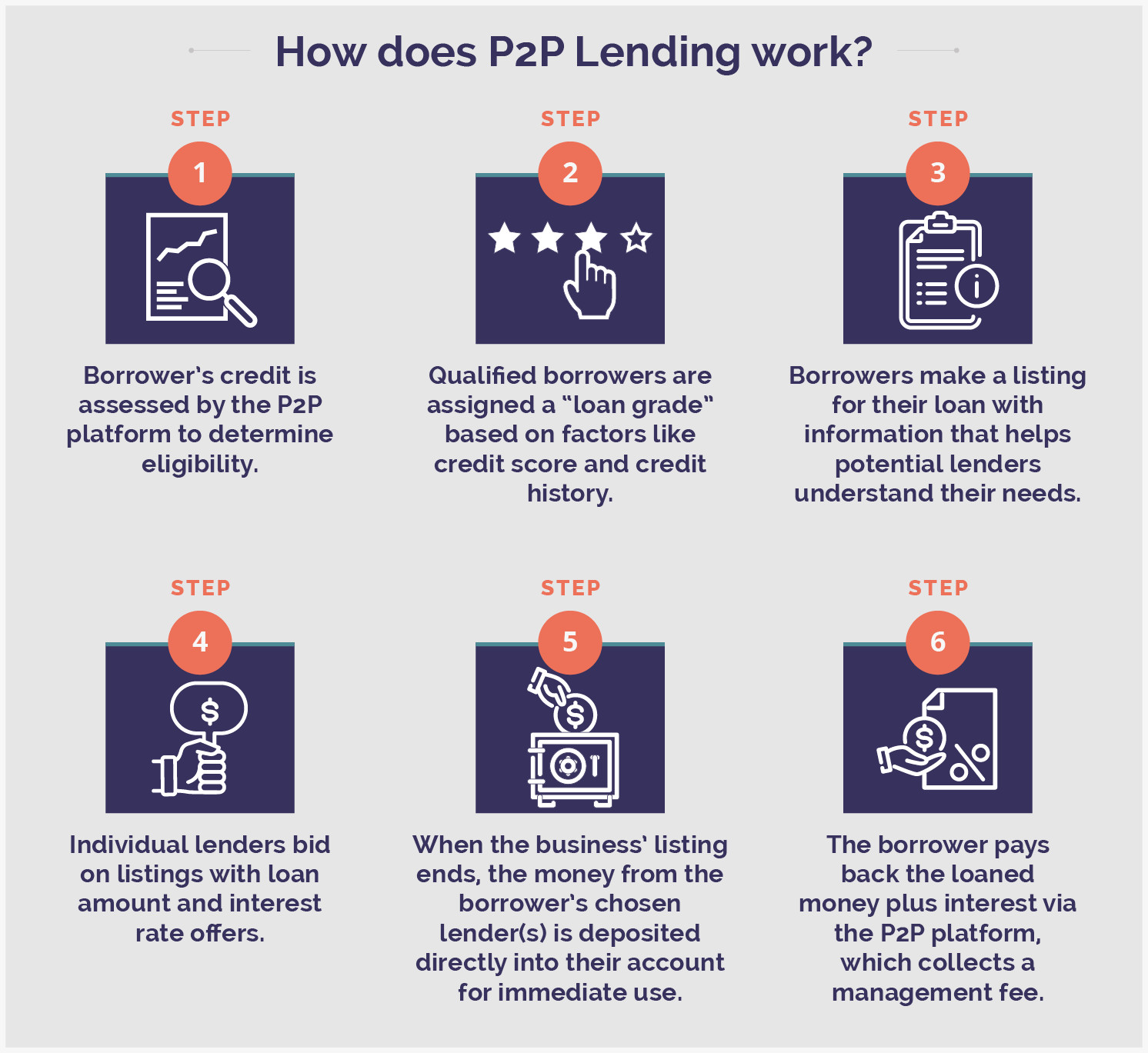

Apply Peer-to-peer P2P loan or Lend your money online on Indias best P2P lending marketplace IndiaMoneyMart. P2P lending is generally done through online platforms that match lenders with the potential borrowers.

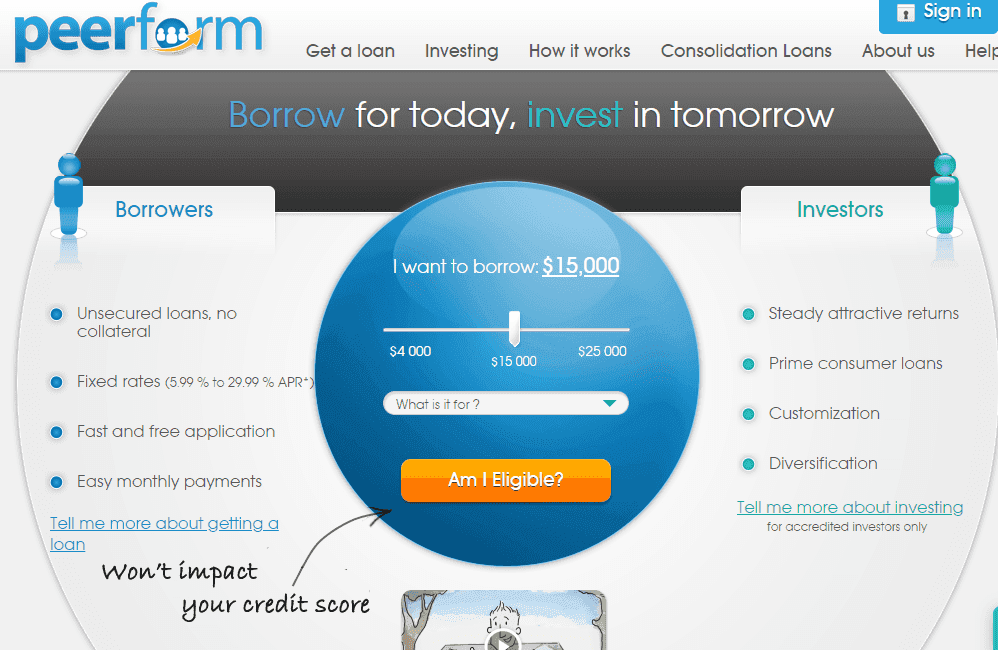

What You Need To Know When Applying For A Personal Loan Infographic Peerform Peer To Peer Lending Blog Personal Loans How To Apply Peer To Peer Lending

Prosper has facilitated more than 21 billion in loans to over 13M people.

. Lending Club investors for example have historically had returns between 526 and 869. Every investment comes with some amount of risk and peer-to-peer lending is no exception. Of the six lenders reviewed in this article two are good prospects for a short-term cash advance with no hard credit check.

Guaranteed loans with no credit check do exist. LendingClub is Americas largest lending marketplace connecting borrowers with investors since 2007. P2P personal loans are offered directly to individuals without the intermediation of a bank or traditional financial institution.

Peer-to-peer loans lack the same liquidity that youd find in stocks or bonds. From better ROI to more security the best peer-to-peer lending sites can help you meet your goals. Our peer-to-peer loans allow people of all credit histories to get access to the funds they need.

Peer-to-peer P2P lending looks like savings but with higher interest eg 5 acts like savings but smells like investing. Customers can apply to borrow 100 to repaid over 4 to 6 months in equal repayments. Investors-Our platform offers global investors the opportunity to earn attractive returns by directly investing in strong creditworthy businesses via peer to peer lending.

Before you use your cards check your available line of credit and your monthly interest rate. Discover a credit card personal loans or home equity options. No matter what type of loan you choose always make sure that you understand all of your financial responsibilities before you sign on the dotted line.

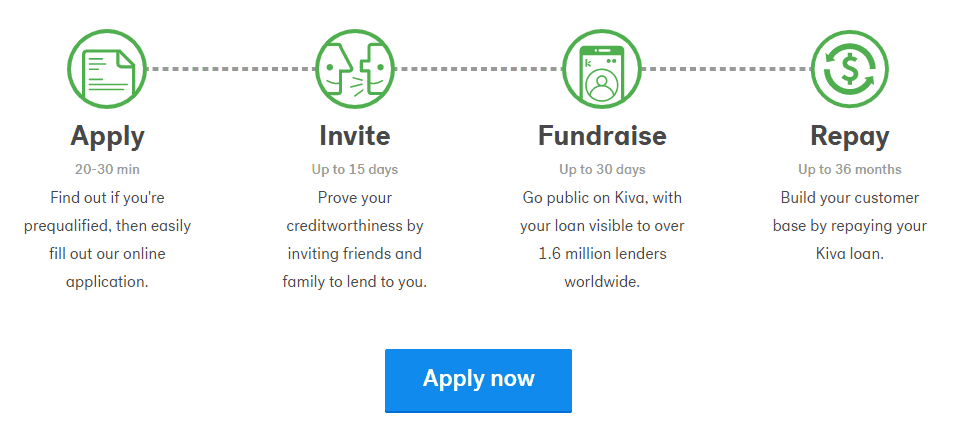

And because we dont have any brick-and-mortar locations were able to keep. Please provide proof that these criteria. Heres how the process.

Loansolo a lending company with fair no credit check loans and a high approval rate for bad credit score borrowers. As weve warned it ISNT covered by the UK savings safety net which protects bank building society and credit union savings up to 85k per person per institution if. Our automated simple-to-use transparent and hassle-free P2P Lending Platform ensures that the borrowing needs of salaried individuals are met quickly and efficiently.

Public blockchains are open-source software so anyone can access them to view transactions and their source code. All P2P NBFC loan projects at RupeeCircle undergo stringent credit analysis including CIBIL- check as well as physical verifications so that a diverse range of robust loan. As the lender you have the ability to choose the borrowers and are able to spread your investment amount out to mitigate your risk.

They can even use the code to build. Peer-to-peer loans are funded by individual and institutional investors. Peer-to-peer lending is a special option that comes with its own requirements terms and conditions.

The stock market dips from time to time and theres no guarantee that youll see a return on your investments. Choosing the right peer to peer lending sites is crucial if you want to invest your money safely and earn a good return. P2P Credit offers personal loan access up to 40000.

Prosper was founded in 2005 and was the first peer-to-peer lending marketplace in the United States. Peer to peer lenders who suffer bad debts on peer to peer loans from 6 April 2016 and relief conditions are met may also set these bad debts against interest received on other peer to peer loans. When you lend money to individuals you risk them defaulting.

Peer-to-peer offered a. They became popular for borrowers especially those with low credit scores after the 2008 financial downturn when many traditional banks lending requirements tightened. In this guide I ranked and reviewed the 7 best peer-to-peer lending sites so that you can pick the best one for you.

Peer-to-peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. By investing in a peer-to-peer loan you wont have to deal with so much volatility and youre more likely to see a positive return. Now avail personal loans even with bad credit scores Indian Individuals and corporate lenders can lend money online to eligible borrowers and earn high returns on Investments on this lending platform.

From the borrowers perspective peer-to-peer lending looks a lot like applying for a personal loan or some other type of financing. LenDenClub is the largest Peer-to-Peer Lending Platform in India. Our flexible terms mean that there are no late fees and we will always work with our customers to minimise default or bad debts.

Peer-to-peer lending sites dont come with FDIC insurance like a CD or saving account. Finally get the funds in no time with peer to peer business lending at RupeeCircle. AnyTimeLoan Aims for Loan Disbursal of Rs100 Crore Per Month.

Our LC TM Marketplace Platform has helped more than 4 million members get over 70 billion in personal loans so they can save money pay down debt and take control of their financial future. BestEgg has it all. Peer-to-peer loans are exposed to high credit.

P2P lending is the practice of loaning money to borrowers who typically dont qualify for traditional loans. We compared and reviewed the best peer-to-peer lenders based on loan rates fees required credit score and more. As per the recent reports AnyTimeLoanin - an on-demand peer-to-peer P2P lending platform that was founded by Neha Jain and Keerthi Kumar Jain in 2014 - has finally received its NBFC P2P licence from the Reserve Bank of India RBI.

Online P2P Personal Lending and P2P Personal Loan sites are currently allowing people to connect with one another to get loans online - with real money and in real time. Peer review of study protocols BMJ Open will consider publishing without further peer review protocols that have formal ethical approval and have undergone independent peer review to gain funding from a recognised open access advocating research-funding body such as those listed by the JULIET project. Cryptocurrencies like Bitcoin let you send money directly to anyone anywhere in the world without an intermediary like a bank charging transaction or handling fees.

All those with an income greater than 0 can apply for the loan and enjoy flexible repayment terms. Peer to Peer Lending. The money goes straight to your bank account through direct peer to peer credit.

Heres how the process works. But the guarantee is really an assurance that the lender will do everything possible to get you a loan notwithstanding your low credit score. 1FirstCashAdvance is a trusted matching service launched to connect applicants with direct payday lendersThe lenders from 1FirstCashAdvance provide short-term unsecured loans with no hard credit checks through.

Our Term Finance offering allows investors to earn 10 average ARR and Working Capital Finance is a great way to make short term investments. News About Peer to Peer Lending. Check Eligibility Learn More.

Apply fully online to borrow up to 35000 and get same-day funding. This peer-to-peer lending platform caters to individuals and small businesses alike. Preapprovals with a soft credit check no prepayment penalties or.

It connects investors looking for high returns with creditworthy borrowers looking for loan. Right now PeerStreet is one of the best lending platforms out there.

Here Is Everything You Need To Know About Peer To Peer Lending Peer To Peer Lending Peer Social Finance

Peer To Peer Lending Bad Credit Fifi Finance

Pin On Hard Money Lenders

Peer To Peer Lending Bad Credit Fifi Finance

Pin On P2p

Pin On Peer Finance Money Tips Personal Finance

This Board Talks About A New And Radical Investment Option Peer To Peer Lending In Order To Encourage The Inve Peer To Peer Lending Peer Investment Portfolio

Personal Loan Apply Online Peer To Peer Lending Personal Loans Best Payday Loans

Sunny Loans Bad Credit Personal Loans No Credit Check Loans Bad Credit

6 Best Online Peer To Peer Loans For Bad Credit 2022 Badcredit Org

The Best Peer To Peer Loans For Bad Credit Of September 2022 Credit Summit

Pin On P2p Lending India Infographics

Top Options For Peer To Peer Business Lending Lantern By Sofi

U S Treasury Launches Study Of Peer To Peer Lending Learn More Http Buff Ly 1j49nx8 Online Lending Peer To Peer Lending The Borrowers

Pin On Rock Your Credit Score

Peer To Peer Lending Types Advantages

How To Get A Personal Loan Personal Loans Loan Get A Loan